In 2022, global liquefied natural gas volumes hit a record high, driven by Europe’s scramble to replace Russian pipeline gas. Total LNG imports in 2022 hit 409 million tons compared to 379.6 million tons the year before. Europe was the premium market for LNG in 2022, but returning demand from Asia is likely to make markets more competitive this year, Oil Price writes.

Global imports of liquefied natural gas (LNG) hit a record high of 409 million tons last year, as Europe scrambled to replace Russian pipeline gas supply and outbid Asia to draw the majority of cargoes.

The global LNG imports of 409 million tons in 2022 were up from world imports of 386.5 million tons in 2021, per data from Refinitiv quoted by Reuters’ Asia Commodities and Energy Columnist, Clyde Russell.

Commodity analytics firm Kpler puts the 2022 global LNG imports at 400.5 million tons, an increase compared to imports of 379.6 million tons in 2021.

Europe’s pivot to LNG has created a demand shock to an already tight global LNG market, with additional 50 million tons annually of EU demand, London-based consultancy Timera Energy said in November. Europe’s role in the LNG market sharply changed from a passive and flexible LNG sink to a direct and aggressive competitor, Timera Energy noted.

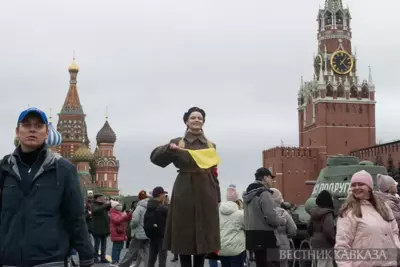

While Asia was the primary destination of LNG in previous years, Europe emerged as the premium market for liquefied natural gas as it seeks to replace Russian pipeline gas supply. Europe is estimated to have imported nearly one-quarter of all LNG traded last year, winning the competition with Asia, as European benchmark prices surged after Russia started cutting off pipeline supplies.

In 2022, the EU’s imports of LNG hit 101 million tons, which was a 58% surge compared to 2021, per data from Refinitiv cited by the Financial Times. The EU imported a total of 24% of all LNG traded last year, according to the data.

Much of the European LNG imports were aided by lackluster demand in Asia, where China saw a rare drop in gas consumption amid a slowdown in economic growth, while most of South and Southeast Asia simply couldn’t afford the skyrocketing spot LNG prices.

Despite the recent plunge in the European benchmark gas prices to below the North Asian benchmark, Europe continues to attract most of the U.S. exports of LNG as demand in Asia is still weak.