Investors have rushed out of equities and into havens such as gold and US government bonds following a surge in coronavirus cases in Italy, South Korea and Iran over the weekend that intensified concerns over the global impact of the virus, Financial Times writes in the article Global stocks slide after Italy’s coronavirus lockdown. European equities opened sharply lower on Monday. The continent-wide Stoxx 600 tumbled 3 per cent in its heaviest sell-off since late 2018. Germany’s Dax and France’s CAC 40 dropped 3.3 per cent, while the UK’s FTSE 100 fell 2.7 per cent.

The drop echoed falls in several major Asian markets. Seoul’s Kospi sustained a particularly severe blow, falling 3.9 per cent — its worst day since late 2018 — after South Korea raised its infectious disease alert to its highest level for the first time in a decade. S&P 500 futures, which track Wall Street’s benchmark stock barometer, dropped 2.2 per cent with several hours to go before the opening bell in New York.

The sell-off came after Italy imposed a strict quarantine across at least 10 towns, as authorities battled to contain the biggest outbreak of the virus outside Asia. Officials said on Sunday that a third person in Italy had died from the virus as a sharp rise in the infection count to 152 fuelled fears over the disease’s spread through Europe.

Robert Carnell, chief Asia-Pacific economist at ING, said: “Markets [are] likely to show extreme caution in the face of [the] global spread of the coronavirus — this is no longer solely an Asia issue.”

Assets that are considered to be shelters during times of rising market jitters rallied. The 10-year Treasury yield, which moves inversely to price, fell 9 basis points to 1.38 per cent, the lowest level since July 2016. Gold rallied 1.5 per cent to $1,667 a troy ounce — lifting the yellow metal’s price to the highest level in seven years.

Oil, one of the commodities that has been hit by concerns the coronavirus outbreak will stunt global economic growth, declined on Monday. Brent crude, the global marker, fell 2.8 per cent to $56.89 a barrel. “The coronavirus outbreak is starting to rattle . . . asset markets and should keep weighing on commodities’ demand,” said Aakash Doshi, head of commodities research in North America at Citigroup. “If virus risks keep spreading outside of China, causing broader downturns in equities and [corporate bond] markets, commodities’ prices should face further short-term headwinds.”

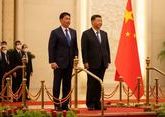

Chinese authorities reported that only 11 new cases had been discovered outside Hubei on Sunday, which would suggest the spread of the virus had slowed in the rest of the country. President Xi Jinping’s administration has been racing to contain the epidemic outside Hubei province, where it originated, to bring the world’s second-largest economy back up to full speed as soon as possible.

But in an indication of just how difficult that will be, Mr Xi told thousands of Chinese government and Communist party officials on Sunday that the epidemic was the “most difficult” public health challenge the party had faced, and that it had also exposed “obvious shortcomings” in governance.